Bravo’s PawnTech Report: http://info.bravostoresystems.com/bravo-2021-pawntech-report

The Pawn Industry and Its Customers: The United States and Europe: Report: http://papers.ssm.com/sol3/papers.cfm?abstract_id=2140575

Pawnshops and Behavioral Economics: https://www.bu.edu/rbfl/files/2013/Pawnshops-Behavioral-Economics-and-Self-Regulation.pdf

The Truth About Pawnshops: https://www.nationalpawnbrokers.org/assets/2021/08/Truth-About-Pawn-Shops-printable-version.pdf

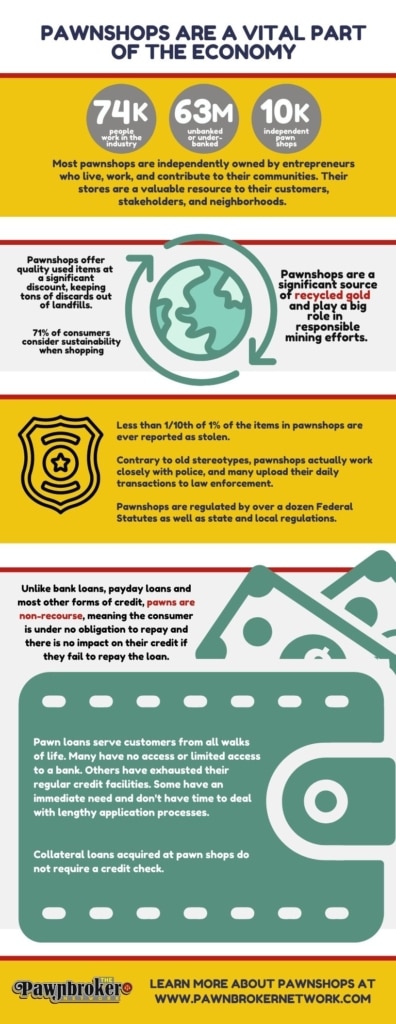

Here are some important ways that pawnshops are a vital part of the economy:

Pawnshops by the numbers

Pawnshops add value to the economy in many ways. Here are some important industry statistics. Read our editor’s opinion on Medium.

There are more than 74,000 people who work in this industry.

Millions more are served by pawnshops to meet their financial needs. As one specific example, more than 63 Million Americans are unbanked or underbanked and rely on alternative lenders for financial needs.

Approximately 10,000 pawnshops are independently owned by entrepreneurs who live, work, and contribute to their communities. Their stores are a valuable resource to their customers, stakeholders, and neighborhoods.

Pawnshops are good for the environment

Pawnshops offer quality used items at a significant discount, keeping tons of discards out of landfills.

Pawnshops are a significant source of recycled gold and play a big role in responsible mining efforts.

Pawnshops and the police

Less than 1/10th of 1% of the items in pawnshops are ever reported as stolen.

Contrary to old stereotypes, pawnshops actually work closely with police, and many upload their daily transactions to law enforcement.

Pawnshops are regulated by over a dozen Federal Statutes as well as state and local regulations.

Pawnshops and personal finance

Unlike bank loans, payday loans and most other forms of credit, pawns are non-recourse, meaning the consumer is under no obligation to repay and there is no impact on their credit if they fail to repay the loan.

Pawn loans serve customers from all walks of life. Many have no access or limited access to a bank. Others have exhausted their regular credit facilities. Some have an immediate need and don’t have time to deal with lengthy application processes.

Collateral loans acquired at pawn shops do not require a credit check. There is no other financial product that’s the same as a pawn.

Please SHARE this information: