Read the full report at CFPB.gov:

In a new report in our Making Ends Meet series, we find that consumers who use a payday, auto title, or pawn loan in one year are often still using that type of loan a year later. Some users of these services have lower cost credit available on credit cards, while others lack access to traditional credit. Among payday, auto title and pawn loan borrowers who experience significant financial shocks, the costs of these shocks often exceed other possible sources of funds.

Payday, auto title, and pawn loans in the Making Ends Meet Survey

We use questions about payday, auto title, and pawn loans in the first two waves of the Bureau’s Making Ends Meet survey, conducted in June 2019 and June 2020, to examine how consumers use these services. The survey’s sample is drawn from traditional credit bureau data, so the survey does not provide insight into users of these services who do not have traditional credit records. But it does allow us to examine other credit characteristics such as whether these consumers appear to have readily available credit on credit cards. The Making Ends Meet survey thus gives us a rare opportunity to combine a survey of the same consumers over two years with traditional credit record data to understand consumers’ decisions about debt.

In June 2019, 4.4 percent of consumers had taken out a payday loan in the previous six months, 2.0 percent had taken out an auto title loan, and 2.5 percent had taken out a pawn loan. Users of these services are more concentrated among the age group between 40-61, consumers with at most a high school degree, Black and Hispanic consumers, low-income consumers, and women. Because the number of consumers using these loans in the survey is small, there is some survey uncertainty in these estimates.

Rollover or repeat borrowing is common

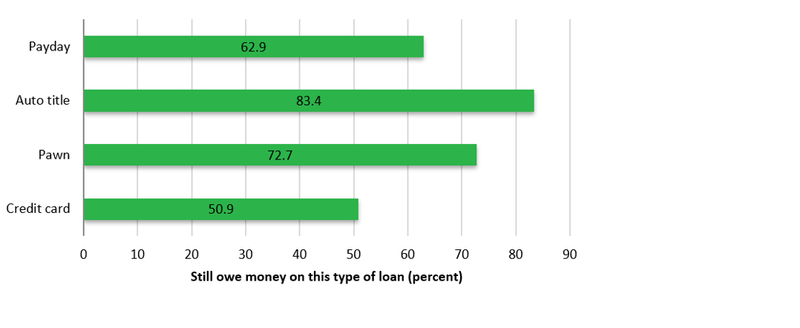

FIGURE 1: SHARE OF POPULATION THAT STILL OWED MONEY ON THIS TYPE OF LOAN, IF HAVE TAKEN ONE OUT IN SIX MONTHS PRIOR TO JUNE 2019 (PERCENT)

The survey results suggest that consumers frequently roll over these loans or take out a new loan soon after re-paying the previous loan. In June 2019, of the consumers who had taken out a loan in the previous six months, 63 percent still owed money on a payday loan; 83 percent still owed money on an auto title loan; and 73 percent still owed money on pawn loans (Figure 1). These loans are typically of short duration—30 days or fewer for payday and auto title loans—so still owing money suggests repeat borrowing or rollover. In the survey, 48 percent of consumers who had taken out a payday loan in the previous six months had rolled over at least one payday loan in the previous six months. For comparison, 51 percent of all consumers with a credit card in the survey did not pay the full bill in the previous month in June 2019.